550 for funds up to $150K. 600 for funds up to $250K.

Yes, on full doc only and with a minimum credit score of 650.

20 years end of term.

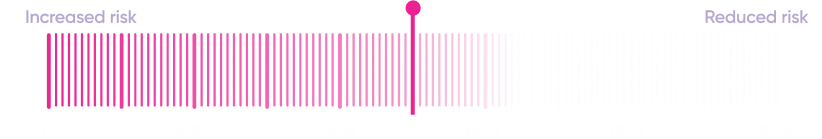

Equifax Veda 1.1 Negative reporting (which is different to the Equifax Comprehensive reporting).

Your customer must be trading for two years & meet our minimum credit score. GST registration is not required.

Yes, up to $100K. A 20% deposit is required.

This depends on your customers credit score. 550 credit score qualifies for 150k. 600 credit score qualifies for 250K. 650 credit score qualifies for 250K+.

We can accept paid telco or trade defaults up to $2,500. Any other defaults/liquidations etc., will not be accepted.

Yes: 36 & 48 Months – max 40% ; 60 Months – max 30%.

Yes. Please note, if the spouse does not have the same surname, we will need proof of relationship via joint utility bill and/or joint bank statement.

No.

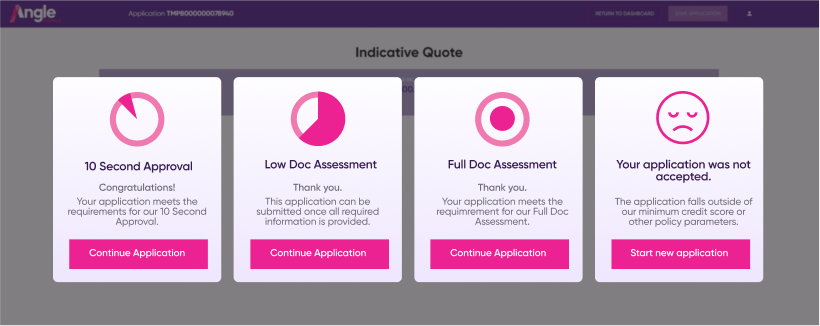

ABN has been trading for less than 2 years. Applicant is a boarder. Refinance of other company balloons or loans. Or above our low doc threshold.

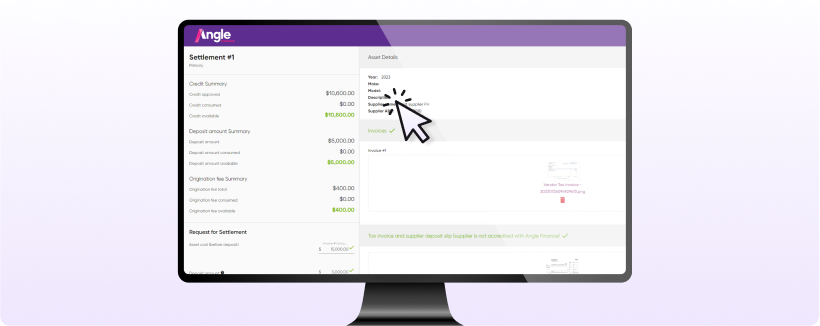

Yes, provided they are all the same asset type (e.g. primary); same supplier type (e.g. can’t do a dealer & private sale in the one contract) and are ready for delivery at the same time.

Yes, if the customer meets:

- Same business & industry.

- Same ownership (e.g. 1 Sole Trader to 1 Shareholder).

No, however applicants that do not qualify for low doc can be assessed with six months bank statements or financials.

Bootcamp

Bootcamp

you how to

you how to  network

network

win a customer against a

win a customer against a  dealer

dealer