My Contacts

I need to speak

to a BDM

to a BDM

I need to speak to a

Credit Analyst

Credit Analyst

I need to speak to a

Settlements Officer

Settlements Officer

My customer needs a payout

quote or payment summary

quote or payment summary

My customer has missed a payment,

how can you help?

how can you help?

Your best point of contact is our Sales Department

Narelle Bruni

VIC/SA/TAS

VIC/SA/TAS Snr Business Development Manager

Email narelle.bruni@anglefinance.com.auContact no. 0492 279 976 David Clark

QLD

QLD Business Development Manager

Email david.clark@anglefinance.com.auContact no. 0474 902 783 Bonita Camden

NSW

NSW Snr Business Development Manager

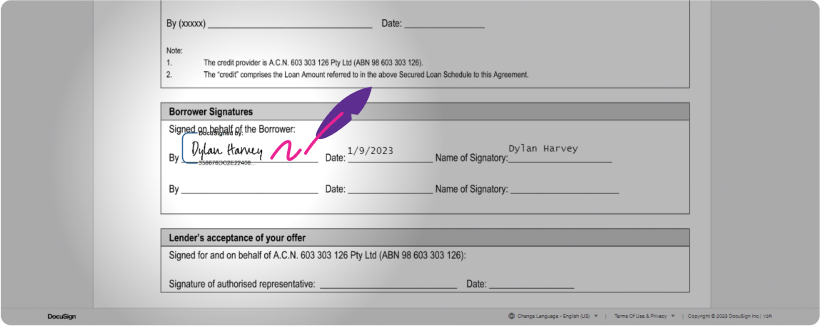

Email bonita.camden@anglefinance.com.auContact no. 0466 329 368 Dylan Harvey

NSW

NSW Business Development Manager

Email dylan.harvey@anglefinance.com.auContact no. 0410192905 Jonathan Hill

VIC

VIC Business Development Manager

Email jonathan.hill@anglefinance.com.auContact no. 0424771353 Sheden Abraha

NSW

NSW Business Development Manager

Email sheden.abraha@anglefinance.com.auContact no. 0406 769 665 Christina Perrin

NSW/QLD

NSW/QLD Business Development Manager

Email christina.perrin@anglefinance.com.auContact no. 0418460113 Ainsley Goncalves

WA

WA Business Development Manager

Email ainsley.goncalves@anglefinance.com.auContact no. 0466344181

Your best point of contact is our Credit Department

Christopher Xavier

Credit Analyst

Email christopher.xavier@anglefinance.com.auContact no. 03 9912 6946 Colleen Camelin

Senior Credit Analyst

Email colleen.camelin@anglefinance.com.auContact no. 03 9912 6963 Cassandra Douglas

Senior Credit Analyst

Email cassandra.douglas@anglefinance.com.auContact no. 03 9912 6964

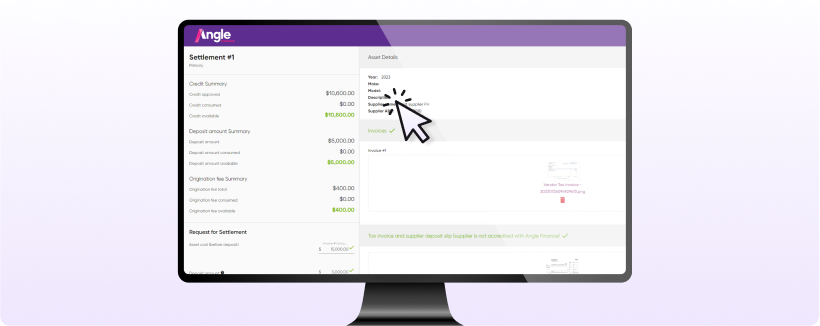

Your best point of contact is our Settlements Department

Your best point of contact is our Concierge Team

Concierge Team

Your best point of contact is our Accreditaions Team

Accreditaions Team

Your best point of contact is our Customer Service Team

Your best point of contact is our Collections Team

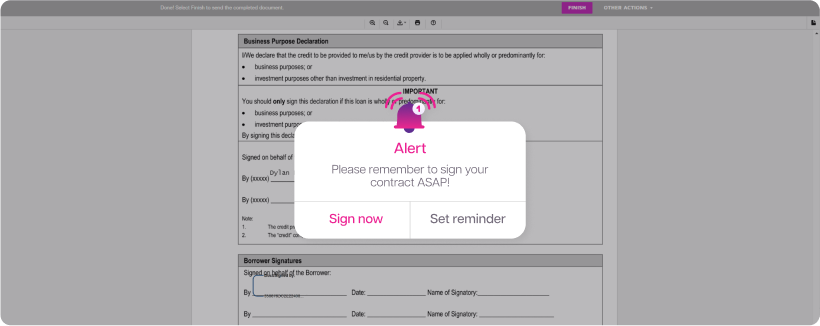

Bootcamp

Bootcamp

you how to

you how to  network

network

win a customer against a

win a customer against a  dealer

dealer